- Best cryptocurrency to buy april 2025

- Cryptocurrency market trends february 2025

- Cryptocurrency market outlook april 2025

Cryptocurrency market analysis february 2025

For 2025, Kaspa’s price is expected to fluctuate between $0.089 and $0.19, with a stretched target of $0.25. Investor sentiment and potential partnerships in Kaspa’s ecosystem, combined with institutional interest, may push price towards its stretched target tigerspin legal.

Taki is a chart analyst who is passionate about unlocking unique insights out the chart. While the vast majority of analysts remain focused on price analysis, Taki starts with timeline analysis and adds price analysis to this. In doing so, he developed a unique methodology to find opportunities in financial markets, across assets and markets.

???? BlackRock: Its Bitcoin ETF surpassed $50 billion in assets in just 15 months, underscoring growing institutional demand for crypto exposure. ???? MicroStrategy: Increased its Bitcoin holdings to 447,470 BTC, continuing its long-term accumulation strategy.

In 2025, Ethereum is expected to trade in a wide range with a minimum price of $1,667 and maximum price of $4,911. If and whenever bullish momentum in crypto markets accelerates, ETH may push to our stretched price target of $5,590.

Best cryptocurrency to buy april 2025

Developed to help power decentralized finance (DeFi) uses, decentralized apps (DApps) and smart contracts, Solana runs on a unique hybrid proof-of-stake and proof-of-history mechanisms to process transactions quickly and securely. SOL, Solana’s native token, powers the platform.

The Stacks long term chart looks bullish. It is printing a series of bullish reversal in the context of a long term uptrend. An acceleration point will be hit, sooner or later, presumably on BTC bullish momentum somewhere in 2025.

Cryptocurrency is a form of currency that exists solely in digital form. Cryptocurrency can be used to pay for purchases online without going through an intermediary, such as a bank, or it can be held as an investment.

How much it costs to buy cryptocurrency depends on a number of factors, including which crypto you are buying. Many small altcoins trade for a fraction of a cent, while a single bitcoin will cost you tens of thousands of dollars. However, many brokerages and exchanges now allow fractional trading, offering investors the option to buy a portion of a cryptocurrency.

Based on research and analysis, the cryptocurrency market in April 2025 presents diverse opportunities. Projects like Qubetics, Binance Coin, Sonic, Bitcoin Cash, Bittensor, Chainlink, and Monero each offer unique value propositions, catering to various aspects of the digital economy.

Cryptocurrency market trends february 2025

There will be at least ten stablecoin launches backed by TradFi partnerships. From 2021 to 2024, stablecoins have experienced rapid growth, with the number of projects now reaching 202, including several with strong ties to traditional finance (TradFi). Beyond the number of stablecoins launched, their transaction volume growth has outpaced that of major payment networks like ACH (~1%) and Visa (~7%). In 2024, stablecoins are increasingly interwoven into the global financial system. For example, the U.S.-licensed FV Bank now supports direct stablecoin deposits, and Japan’s three largest banks, through Project Pax, are collaborating with SWIFT to enable faster and more cost-effective cross-border money movements. Payment platforms are also building stablecoin infrastructures. PayPal, for instance, launched its own stablecoin, PYUSD, on the Solana blockchain, while Stripe acquired Bridge to support stablecoins natively. Additionally, asset managers such as VanEck and BlackRock are collaborating with stablecoin projects to establish a foothold in this sector. Looking ahead, with growing regulatory clarity, TradFi players are expected to integrate stablecoins into their operations to stay ahead of the trend, with first movers poised to gain an edge by building the foundational infrastructure for future business development. -Jianing Wu

Tether’s long-standing market dominance will drop below 50%, challenged by yielding alternatives like Blackrock’s BUIDL, Ethena’s USDe, and even USDC Rewards paid by Coinbase/Circle. As Tether internalizes yield revenue from USDT reserves to fund portfolio investments, marketing spend by stablecoin issuers/protocols to pass-through revenue will convert existing users away from Tether and onboard new users to their yield-bearing solutions. USDC rewards paid on users’ Coinbase Exchange and Wallet balances will be a powerful hook that will boost the entire DeFi sector and may be integrated by fintechs to enable new business models. In response, Tether will begin to pass through revenue from collateral holdings to USDT holders and may even offer a new competitive yielding product like a delta-neutral stablecoin. -Charles Yu

The key level to watch for PEPE is $0.00000633, which represents PEPE’s 38.2% Fibonacci level acting as a a critical support and potential rebound point. A successful rebound from this level could confirm a lasting bottom. The meme coin’s performance will largely depend on market sentiment and social media trends.

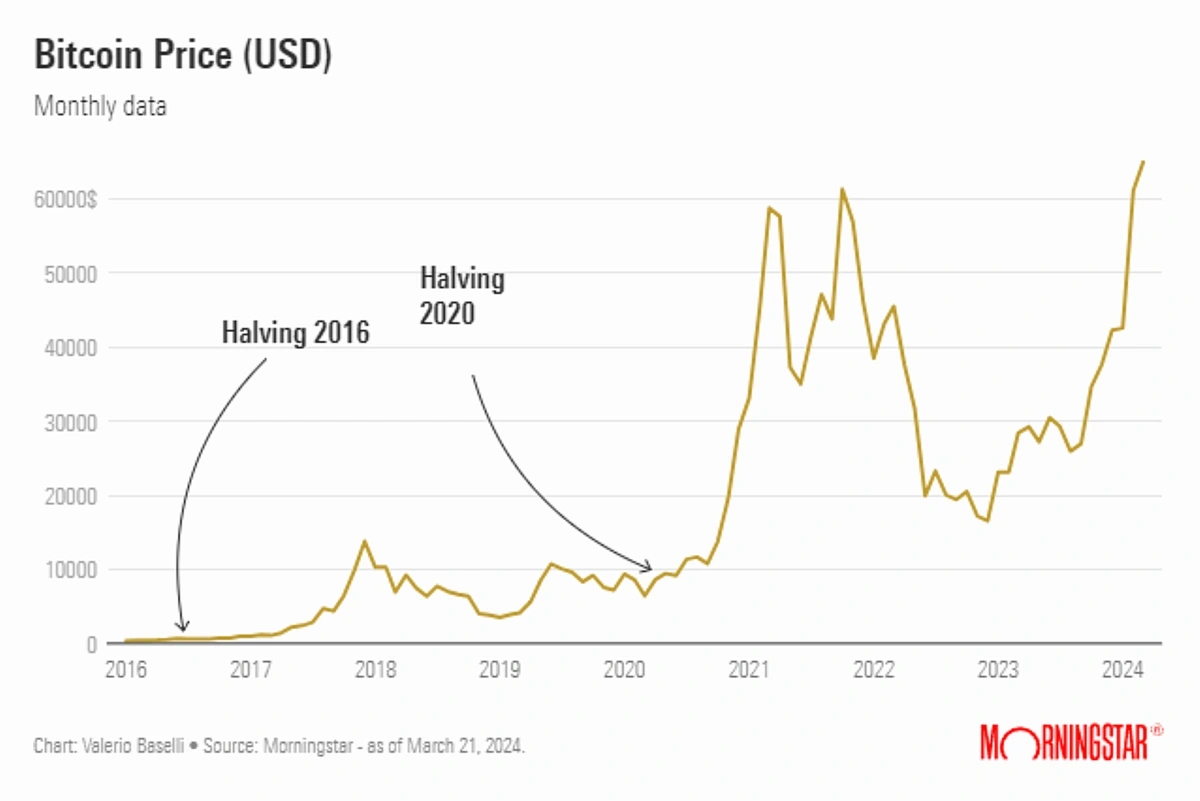

The Bitcoin halving event in April 2024 continued to influence prices. Reduced supply and increased demand from ETFs pushed BTC to near $100,000, with analysts predicting a breakout above $120,000 by mid-2025.

There will be at least ten stablecoin launches backed by TradFi partnerships. From 2021 to 2024, stablecoins have experienced rapid growth, with the number of projects now reaching 202, including several with strong ties to traditional finance (TradFi). Beyond the number of stablecoins launched, their transaction volume growth has outpaced that of major payment networks like ACH (~1%) and Visa (~7%). In 2024, stablecoins are increasingly interwoven into the global financial system. For example, the U.S.-licensed FV Bank now supports direct stablecoin deposits, and Japan’s three largest banks, through Project Pax, are collaborating with SWIFT to enable faster and more cost-effective cross-border money movements. Payment platforms are also building stablecoin infrastructures. PayPal, for instance, launched its own stablecoin, PYUSD, on the Solana blockchain, while Stripe acquired Bridge to support stablecoins natively. Additionally, asset managers such as VanEck and BlackRock are collaborating with stablecoin projects to establish a foothold in this sector. Looking ahead, with growing regulatory clarity, TradFi players are expected to integrate stablecoins into their operations to stay ahead of the trend, with first movers poised to gain an edge by building the foundational infrastructure for future business development. -Jianing Wu

Tether’s long-standing market dominance will drop below 50%, challenged by yielding alternatives like Blackrock’s BUIDL, Ethena’s USDe, and even USDC Rewards paid by Coinbase/Circle. As Tether internalizes yield revenue from USDT reserves to fund portfolio investments, marketing spend by stablecoin issuers/protocols to pass-through revenue will convert existing users away from Tether and onboard new users to their yield-bearing solutions. USDC rewards paid on users’ Coinbase Exchange and Wallet balances will be a powerful hook that will boost the entire DeFi sector and may be integrated by fintechs to enable new business models. In response, Tether will begin to pass through revenue from collateral holdings to USDT holders and may even offer a new competitive yielding product like a delta-neutral stablecoin. -Charles Yu

Cryptocurrency market outlook april 2025

You are leaving the Galaxy website and being directed to an external third-party website that we think might be of interest to you. Third-party websites are not under the control of Galaxy, and Galaxy is not responsible for the accuracy or completeness of the contents or the proper operation of any linked site. Please note the security and privacy policies on third-party websites differ from Galaxy policies, please read third-party privacy and security policies closely. If you do not wish to continue to the third-party site, click “Cancel”. The inclusion of any linked website does not imply Galaxy’s endorsement or adoption of the statements therein and is only provided for your convenience.

2024 saw a monumental shift for Bitcoin and digital assets. New products, record inflows, monumental policy shifts, growing adoption, and solidification of Bitcoin as an institutional asset marked 2024.

Bitcoin developers will reach a consensus on the next protocol upgrade in 2025. Since 2020, Bitcoin Core developers have debated on which opcode(s) could safely enhance transaction programmability. As of December 2024, the two most supported pending opcodes for transaction programmability include OP_CTV (BIP 119) and OP_CAT (BIP 347). Since Bitcoin’s inception, reaching consensus on soft forks has been a time-consuming and rare feat, but consensus will emerge in 2025 to include OP_CTV, OP_CSFS, and/or OP_CAT in the next soft fork upgrade, although that upgrade will not activate in 2025. -Gabe Parker

In the medium term (6-12 months), if ecosystem activity significantly increases after the upgrade (such as DeFi TVL growth, Layer 2 transaction volume doubling), ETH may start a new cycle; conversely, if competing public chains continue to squeeze market share, prices may face pressure.

April 2025 crypto market outlook: Analysis of Fed policy, Trump tariffs, ETH Pectra upgrade, and inflation data. Will Bitcoin’s historical April strength prevail despite limited catalysts? Market projections through June.